Reviews

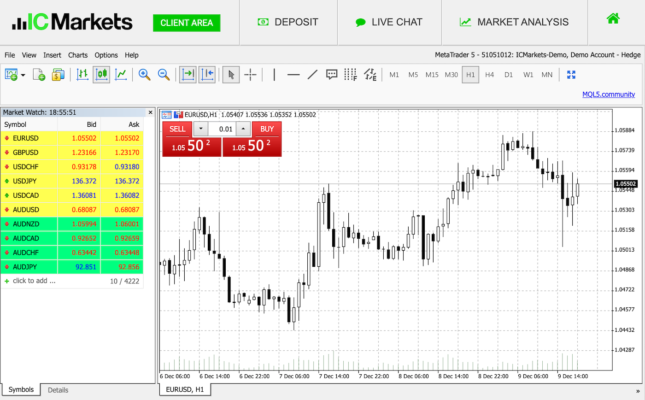

IC Markets is popular among traders seeking a secure and reputable trading platform. The exchange trades various financial assets, such as FX, CFDs, stocks, indices, and commodities. As a result, it is a versatile platform that can fulfill the needs of a wide range of traders. In addition to a large choice of trading instruments, IC Markets offers several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. Allows traders to choose the best platform that fits their trading style and interests. While there are various advantages to using IC Markets, there are also potential disadvantages. Some traders, for example, may perceive a need for educational materials as a disadvantage, mainly if they are new to trading. Furthermore, some traders may be put off by the inactivity penalties levied on accounts with no trading activity.

Pros of Using IC Markets

High level of regulation and security measures

Some of the most stringent regulatory bodies oversee IC markets, including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These regulatory bodies ensure that the platform adheres to strict guidelines and procedures to provide its users with high security.

Wide range of trading instruments

IC Markets offers traders a diverse range of financial instruments to trade, including over 60 currency pairs, 19 commodity markets, and more than 120 stock indices. On the platform, traders can also access CFD trading for stocks, commodities, and indices. With such a diverse range of markets available, traders can diversify their portfolios and access a wide range of opportunities, making IC Markets an appealing option for traders seeking a diverse range of trading options.

Low Trading Fees and Spreads

IC Markets is known for its competitive trading fees and spreads, making it an attractive option for cost-conscious traders. Forex trading fees start at 0.0 pips, and stock and commodity trading fees start at 0.01%, resulting in significant cost savings for high-volume traders. Additionally, them offers commission-free trading on some account types, providing even more savings. These competitive fees and commissions can help traders maximize their profits and keep their trading costs low. Traders can be confident that they are receiving the best possible value when they trade with IC Markets. Overall, them cost-effective pricing structure is one of its most appealing features.

Multiple Trading Platforms to Choose From

IC Markets offers multiple trading platforms, such as MetaTrader 4, MetaTrader 5, and cTrader. Traders can choose the platform that best suits their trading approach and level of experience. MetaTrader 4 has a user-friendly interface and advanced charting tools, while cTrader is popular among traders desiring a personalized trading environment. IC Markets' broad spectrum of platforms ensures that traders have access to the tools they need to trade effectively. The MetaTrader 5 platform offers additional features, including a larger number of timeframes and a more advanced order administration system. Overall, IC Markets' diverse range of trading platforms caters to a comprehensive range of traders, providing them with options that suit their individual needs.

Efficient and reliable customer support

IC Markets' customer support team is available 24/7 to assist traders with any questions or concerns via email, phone, or live chat. Traders can communicate with the team using their preferred method of communication. The support team is well-trained and known for their quick response times and outstanding service. This makes it simple for traders to get the help they need when they need it. IC Markets' reliable and effective customer service ensures that merchants can focus on their trading activities with confidence and peace of mind.

The Cons of Using IC Markets

Limited Educational Resources for Beginners

IC Markets does not provide many instructional resources for novices. While the site offers some basic guidelines and tutorials, more comprehensive resources such as webinars, seminars, and courses are restricted.

Inactivity Fees for Accounts with No Trading Activity

IC Markets levies a $15 monthly inactivity fee for accounts without trading activity for at least six months. This cost can be an issue for traders who only trade intermittently or cannot achieve the trading requirements. For accounts that have not had any trading activity for at least six months, them is charges a $15 monthly inactivity fee. This cost can be problematic for traders who only trade regularly or cannot meet the trading requirements.

Limited Payment Options

IC Markets accepts only bank transfers, credit/debit cards, and some e-wallets as payment methods. Some traders who prefer different payment methods may find this unpleasant.

No cryptocurrency deposits or withdrawals

IC Markets does not accept cryptocurrency deposits or withdrawals, which could disadvantage traders who want to conduct cryptocurrency transactions.

Overall user experience on IC Markets

Moving on to the overall user experience on IC Markets, this part will assess several elements that can impact the user's trading experience.

Ease of Use and Navigation of the Platform

The IC Markets platform is well-designed and user-friendly, with an easy-to-navigate layout. The platform is offered in various languages, including English, Spanish, German, Chinese, and others, making it accessible to traders worldwide.

One of the most striking features of the platform is the ability to personalize the trading interface, which allows traders to arrange the various trading instruments, tools, and charts to their liking. Furthermore, the platform's extensive charting tools and technical analysis indicators make it easy for traders to assess market patterns and make informed trading decisions.

Reliability and Speed of Order Execution

IC Markets has its trading servers hosted at Equinix data centers, renowned for their low latency and high-speed connectivity. Traders can execute trades with minimal delays or slippages, giving them a competitive advantage in the fast-paced trading world. This is platform supports algorithmic trading, which is beneficial for traders who want to capitalize on short-term market movements or trade more systematically. This is , traders can take advantage of market opportunities as they emerge. Low latency servers and algorithmic trading capabilities make exchange this a popular choice for traders seeking a competitive advantage. This combination of features helps their appeal to traders who value reliable and rapid trading infrastructure.

Mobile Trading Experience

IC Markets offers a mobile trading software for iOS and Android devices, enabling traders to access their accounts and execute trades on the go. The app's features and tools, such as charting, quotations, and trading interfaces, are similar to those on the desktop platform. Its user-friendly design makes it ideal for merchants who prefer mobile trading. The IC Markets app enables traders to monitor positions, manage their accounts, and keep up with market news from anywhere in the world. The app is a great solution for traders who need to remain connected to the markets.

Customer support experience

IC Markets takes pleasure in offering its customers speedy and dependable customer service. The exchange has numerous channels for contacting customer service, including phone, email, and live chat, all available 24 hours a day, seven days a week. The support staff is competent and responsive and can help traders with any problems or inquiries. IC Markets' website includes a detailed FAQ area and exceptional customer support. This section covers many platform trading topics and can be an excellent resource for traders looking for quick solutions to frequent questions.

Overall Satisfaction of Users

IC Markets is a highly regulated exchange, contributing to its image as a safe and trustworthy trading platform. The exchange is authorized and regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). Furthermore, Them stores client funds in separate accounts with top-tier institutions, protecting them from insolvency. Overall, here is high level of regulation and security measures are crucial to its appeal among traders.

Conclusion

IC Markets is a highly reputable online FX and CFD broker that is renowned for its stringent regulatory compliance, making it a trustworthy and reliable choice for traders. The broker offers a diverse selection of trading products and several trading platforms that cater to the needs of traders with varying levels of experience. The minimal trading costs and spreads, coupled with efficient and dependable customer support, make IC Markets an attractive option for traders of all levels.

However

New traders who require extensive training tools may find IC Markets to be less suitable for their requirements. On the other hand, experienced traders seeking a dependable and efficient trading platform will appreciate the services offered by them. Therefore, traders who value minimal trading costs, various trading products, and multiple trading platforms should seriously consider using exchange as their broker of choice. In conclusion, Here is an excellent option for traders who prioritize reliability, flexibility, and cost-effectiveness.